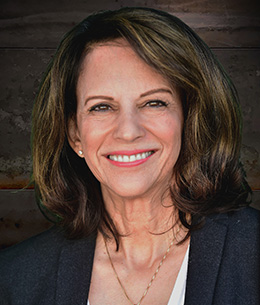

Kathleen Adams CFP® CPWA® RMA®

Founding Partner | Financial Planner

Kathleen Adams, CFP® CPWA® RMA® is a founding partner of Second 50 Financial. As a financial planner for over 20 years, she is in the lifestyle preservation business. She and her team have developed a unique process in order to address the expanded needs of successful business owners who are enjoying a wonderful lifestyle and require a different kind of financial plan.

Kathleen has a Bachelor of Science degree from Loyola University in Chicago, graduating magna cum laude. She earned her CERTIFIED FINANCIAL PLANNER™ certification and completed the Personal Financial Planning (PFP) designation program at UCLA Extension in 2003. In 2015, Kathleen earned the Certified Private Wealth Advisor® designation, in advanced wealth management strategies and applied concepts at The University of Chicago Booth School of Business as well as the Applied Behavioral Finance Certificate enhancing her industry knowledge. Most recently, in 2022 she completed the Retirement Management Advisor® program with the Investments & Wealth Institute®, an advanced certification for financial professionals that provides them with knowledge to help build personalized retirement income plans for their clients focusing on strategies to manage the challenges of today’s world alongside proven solutions from the past.

She chose to work in wealth planning because of her father who loved life and adored his family. Despite building a highly successful professional practice on his own, having no debt and owning substantial real estate, he was not able to live the lifestyle he loved after health issues forced him to sell his practice. His legal, tax and insurance advisors never built a strategy for lifestyle preservation and never communicated. So she and her partner started this planning practice to change the game in planning. Kathleen is originally from Chicago but has lived in Manhattan Beach for the last 30 years with her husband, two daughters and most recently, four grandsons.

(CA Ins. License #0C76833)